As omni-channel personalization moves to center stage in the retail markets, insurance companies are forced to join them. The switch is less about staying afloat with the market trends, it’s become essential for remaining as a business.

Some insurance companies do this right, growing their consumer base through targeted advertisements, appeal of their support, and personalized interfaces. Others are still trying to play catch up in the fast paced digital market.

The Consumer Journey

The battle starts here. So many fronts have opened, thanks to an online world, that reach consumers at various levels. Social media, advertisements, and search engines all attract potential clients and start them on their journey.

Where many companies fail is guiding them through that trip. While customers view every interaction with a business as a collective path, leading them to their desired end-state, insurance companies continue to see each event as singular. The agent is in a different department than the IT team, so how would that affect the customer?

The insurance companies that are dominating the market and continue to grow understand how to integrate their different branches into a unified front. They see the IT guy as part of the journey rather than a separate road the consumer can travel.

More so, in a market where empathy can breed success, customers are starting that journey with well defined interests. Life insurance to help their family after a death. Vehicle insurance to get them back on the road after an accident. Whatever type of insurance they’re requesting is important to them. Identifying this and being able to track it through each of these departments can better assist the customer.

McKinsey reports that “more than 80 percent of shoppers now touch a digital channel at least once throughout their shopping journey”. Try to say the IT guy isn’t an important part of that path now.

More than 80 percent means it’s not only important to be segmenting the audience for personalization, it’s become vital. In the same report, McKinsey stated that, “satisfied customers are 80 percent more likely to renew their policies than unsatisfied customers.”

Through the collection of data points, insurance companies can personalize their approach to the individual, building a crucial sense of trust by tending specifically to the customer’s needs.

Personalization for Insurance

A study by Accenture found that “78 percent of customers say they would share personal information with their insurers to obtain personalized services.” Over a third also claimed they’d willingly pay more for those services.

Personalization isn’t the way in, it’s the way up.

Accenture accurately breaks down the method for personalized interaction with their “4 R’s of Personalization” .

Recognize, Remember, Reach, Relevance.

All personalization starts with the collection of data and insurance companies are no different. The hard part is turning the data into actionable content.

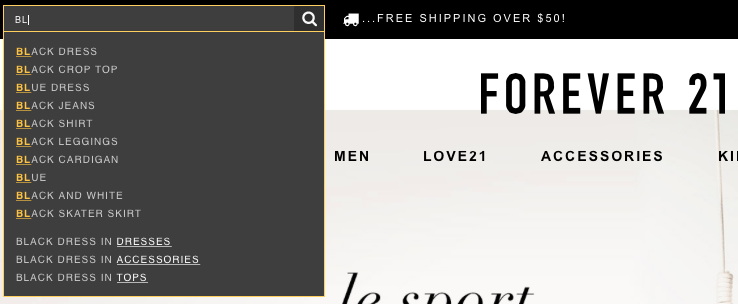

Insurance companies have the opportunity to easily acquire implicit and explicit data. Offering a free quote can be a window to more information than you can use at once, but it’s openly granted by the customer. Through social media engagement and web behavior, insurance companies can study interactions to further develop a marketing strategy and grow their reach.

What’s unique about the insurance market is the agent’s “face to face” interaction with the customer. Emails can be sent from the business’ distribution list to engage a customer, but an agent is able to follow through. They can collect information from the emails and store it under the individual account so any other agent can quickly treat the customer as though they’ve worked together all along.

Exclusive Bonus: Download the FREE overview of the Top 5 Insurance Companies that are Crushing It with Omni-Channel Personalization

Other techniques involve custom 800 numbers that are specific to a page. When the customer uses that number, insurance companies can identify where the customer found it and tailor the interaction to fit their needs.

Personalization for Customer Service

The opportunity to create a more wholesome interaction with the customer is becoming the spear that many companies use to impale themselves. McKinsey saw that the leading insurance companies were the ones delivering better customer experiences and gaining clients who’d grown unhappy with their current provider.

Rapport with the customer grows more important every year as society moves towards a larger digital presence. It’s easier than ever for individuals to find better rates and promotions with other companies, forcing insurance agencies to monitor competition and focus a more direct approach to keeping the customer.

Through personalization, companies can increase brand loyalty and make it harder for other companies to sweep up their client base. Creating that awesome experience can pay for itself, sometimes more so than advertisements and events.

Emails should offer help to the customer’s specific problem, not generic sales. If a customer repeatedly calls rather than using messaging systems, an actual conversation should be held.

These are just a few examples, but when you link them together, they become even stronger.

Omni-channel Personalization

Every personalization technique is wasted if they’re not integrated into a single system. Knowing a customer’s name does nothing unless you track his issues and engage them. With tools like linked Facebook sign-ins, it’s easier to track customer likes and status updates.

Through requests for information or quotes, social media, or browsing history, insurance companies are able to develop a plan for each customer. As customers travel along their journey towards a purchase, companies are using all of these to collect information to engage with them.

With the data collected, they’re able to increase conversions, brand loyalty, and customer satisfaction, while lowering wasted quotes and negative feedback.

All of the companies listed below have an omni-channel personalization strategy. But additionally, they study market trends to see where advertisements and introductions to their business can be made. You’ll be surprised with how some of the companies collect data and put it to work.

Check out these other ways the top dogs in the insurance market have added channels to their business’s personalization.

1. State Farm Group

On their mission page, State Farm acknowledges their customers want a personalized experience. It’s not surprising they achieve it. Their collection of information is best seen through some well developed applications.

State Farm constantly pulls data through their personalized mobile app. The app offers driving routes, weather reports, and reminders for things like A/C filter changes. When it is time for a filter to be swapped, they’ll provide you with a list of the closest stores to purchase one.

When a customer opens the app, they’re seeing a page unique to them, but still connected with the State Farm name.

They also maintain a website called ChaosInYourTown.com where users can enter their actual home address and watch a robot destroy it. This was done as a different way to demonstrate that they’ll always be there for you.

Both of these gather data and put it to immediate use, improving the customer’s experience. Although the latter is more entertaining, it’s a unique technique that has paid off, driving them traffic to other sources and increasing brand awareness. It’s helped to assist them in leading the insurance market by billions of dollars.

Exclusive Bonus: Download the FREE overview of the Top 5 Insurance Companies that are Crushing It with Omni-Channel Personalization

2. Allstate Insurance Group

Allstate uses applications in their own way. Using their mobile app can use the geo-location feature to request assistance after having car trouble. They can also log all of their maintenance requirements and details which can help diagnose the problem.

Along with the geo-location features, if you’re waiting for a flight at an airport, you may get an offer for travel insurance.

While the location data is essential to a lot of their market, they still use other points to recommend different products. Their ‘Personalized Insurance Proposal’ uses and collects data on customers in order to give them a plan that meets the needs unique to them.

These tactics have helped with customer satisfaction overall, allowing Allstate to maintain their enormous client base.

3. Progressive Insurance Group

In 2007, Progressive was proud to offer a personalized experience for their customers. They identified early that treating each customer individually would take them far.

In the same manner, they’re well known for their ’Name Your Price’ program. It pioneered the idea, giving customers a personalized plan based solely off what they wanted to pay.

If leading the way on those fronts wasn’t enough, Progressive, was one of the first to use telematics. This long distance digital information allowed them to see actual driver behavior and reward customers based off their proven records. Discounts were granted for safe driving and, according the a case study by J.D. Power it increased customer satisfaction as a whole.

These, along with their ’Snapshot’, have kept the company growing at a significant rate and it continues to look for ways to improve.

4. Farmers Insurance Group

Farmers Insurance took a very different approach to omni-channel personalization. They partnered with the developers of the FarmVille Facebook game. Through this method, they were able to increase brand awareness and prove they could reach out to customers in various ways.

The strategy allowed them to collect data that users offered by having open social media accounts and connect on a different level. Because they were trying to engage those specific people, it was easy for them to interact. Through a sweepstakes, they were able to show people from the game to their website, offering more chances for conversions.

By coupling the game with a sweepstakes, Farmers more than doubled the amount of likes on their page and was able to gather beneficial information about their fans.

Farmers also became the first company to put a hashtag on a vehicle in a NASCAR race, branching out in a very different way.

5. GEICO

If anyone isn’t familiar with the company that in “15 minutes could save you 15% or more on car insurance” hasn’t turned on a television or radio for years. GEICO, through more than a descriptive slogan, has become a frontrunner in the auto insurance market.

GEICO quickly understood that personalization was the key to their marketing strategy. Through systems within their app, they are able to maintain user information and cut the undesirable wait times from customer interactions.

With their Quick Messaging addition, customers can leave messages for representatives and leave the app. When an agent has a reply, they receive an app push notification. This allows customers to take care of the things they want to, rather than acknowledging hour waits.

More prominently, GEICO’s spokes-character was spawned from their data collection and became one of the best known characters in advertising. After running an initial series of ads, they were able to correlate a growth in customers.

All of these businesses use omni-channel personalization in similar and different ways. The goal for insurance companies is to create a better experience for their customers. Because rates can only drop so low, the best way do this is with exceptional service. Using data, they can tailor interactions to specific individuals and do just that.

Exclusive Bonus: Download the FREE overview of the Top 5 Insurance Companies that are Crushing It with Omni-Channel Personalization